Travel is no longer just about booking flights and packing bags. Today, smart travelers know that the right credit card can turn ordinary trips into extraordinary experiences. From free flights to airport lounge access, travel credit cards offer benefits that can save you money and add comfort to your journey.

However, choosing the best cradit cards for travel can feel confusing. With so many options available, how do you know which card truly fits your lifestyle? That’s exactly what this guide is here for.

In this in-depth blog post, you’ll learn how travel credit cards work, what features matter most, and which types of cards suit different travelers. Whether you travel occasionally or fly every month, this guide will help you make a confident decision.

Why Travel Credit Cards Are a Smart Choice for Modern Travelers

Travel credit cards are designed to reward you for spending money on everyday purchases. Instead of just swiping your card and paying bills, you earn points, miles, or cashback that can be used for flights, hotels, and travel upgrades.

Moreover, these cards often include travel-friendly perks like no foreign transaction fees, free travel insurance, and priority boarding. As a result, your overall travel costs drop while your comfort increases. That’s why frequent travelers rarely travel without one.

Additionally, the best cradit cards for travel help you manage expenses efficiently. You can track spending, convert rewards into real value, and even handle emergencies abroad with ease. In short, these cards don’t just save money—they provide peace of mind.

How Travel Credit Cards Actually Work (Simple Explanation)

At their core, travel credit cards earn rewards when you spend money. For example, you may earn 2–5 points per dollar on travel-related purchases like flights, hotels, and dining. These points can later be redeemed for travel benefits.

Furthermore, many cards offer welcome bonuses. If you spend a certain amount within the first few months, you may receive thousands of bonus points. This alone can cover a free flight or hotel stay, making these cards extremely valuable.

However, it’s important to understand redemption rules. Some cards allow flexible bookings with multiple airlines, while others work with specific travel partners. Therefore, choosing the best cradit cards for travel depends on how and where you like to travel.

Key Features That Make a Travel Credit Card Worth It

Before choosing any card, you should know what features actually matter. First, reward earning rates are crucial. A good travel card should offer higher rewards on travel and dining, as these are common expenses for travelers.

Second, no foreign transaction fees are essential. Many regular credit cards charge extra fees when used abroad. In contrast, travel credit cards usually waive these fees, saving you money on every international purchase.

Lastly, benefits like travel insurance, lounge access, and hotel upgrades add real value. The best cradit cards for travel combine rewards with protection and comfort, ensuring your trip remains smooth from start to finish.

Best Cradit Cards for Travel Based on Travel Style

Not all travelers are the same. Some travel occasionally, while others are constantly on the move. Therefore, the best card for you depends on your travel habits.

If you’re an occasional traveler, a no-annual-fee card with simple rewards may work best. These cards offer basic travel benefits without long-term commitment. On the other hand, frequent travelers benefit from premium cards that provide lounge access, elite status, and higher reward rates.

Additionally, budget travelers should focus on cards with flexible redemption options. Meanwhile, luxury travelers may prefer cards that offer concierge services and luxury hotel perks. Choosing wisely ensures you get the most value from the best cradit cards for travel.

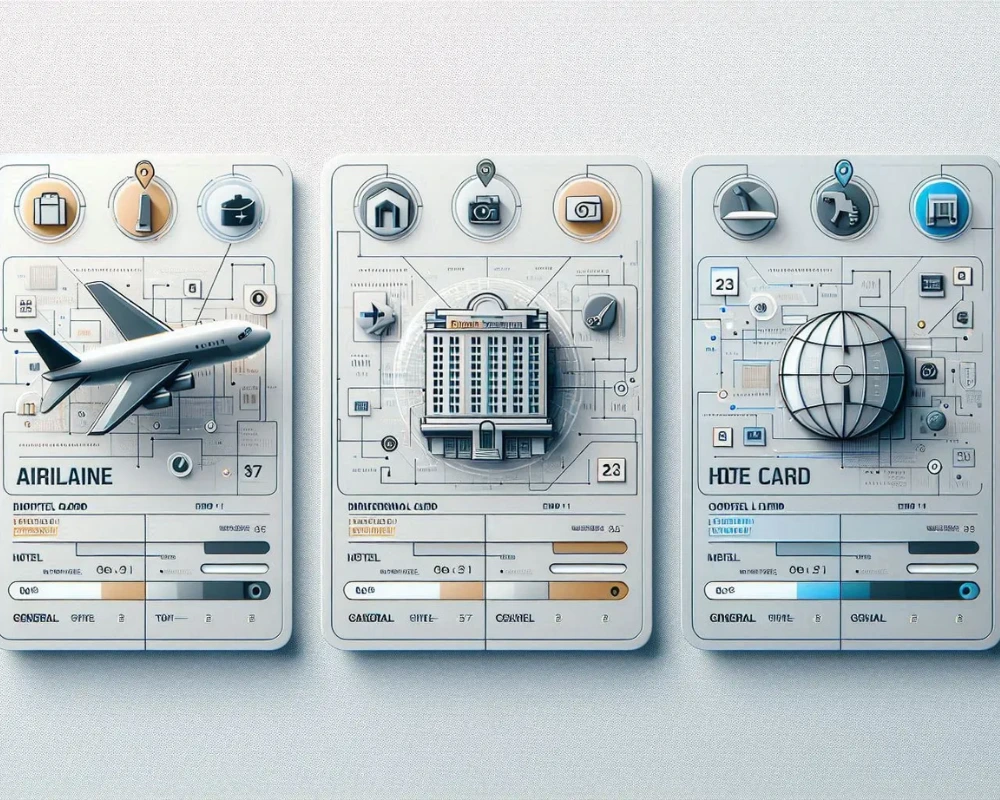

Airline vs Hotel vs General Travel Credit Cards

Travel credit cards fall into three main categories. First, airline credit cards offer perks like free checked bags, priority boarding, and airline-specific miles. These are ideal if you frequently fly with one airline.

Second, hotel credit cards reward you with free nights, room upgrades, and late checkouts. These cards are best if you often stay with a particular hotel chain and want consistent comfort.

Finally, general travel credit cards offer flexible points usable across airlines and hotels. For most travelers, these are the best cradit cards for travel because they provide versatility and freedom in booking options.

International Travel Benefits You Should Never Ignore

When traveling abroad, hidden costs can quickly add up. That’s why international benefits matter so much. A strong travel credit card eliminates foreign transaction fees, saving you up to 3% on every purchase.

Moreover, features like emergency assistance, travel medical insurance, and lost baggage protection can be lifesavers in unexpected situations. These benefits provide security that cash simply cannot offer.

Additionally, many travel cards offer global acceptance and strong fraud protection. This ensures your money stays safe, even if your card information is compromised while traveling internationally.

Are Annual Fees Worth It for Travel Credit Cards?

Many people hesitate to apply for cards with annual fees. However, this fear is often misplaced. While premium travel cards may charge higher fees, the benefits often exceed the cost.

For example, lounge access, free hotel nights, and travel credits can easily offset the annual fee. As a result, you may actually save money in the long run.

That said, if you rarely travel, a no-fee card may be better. The key is matching the card’s benefits with your travel frequency. When used correctly, the best cradit cards for travel always deliver value.

Tips to Maximize Rewards from Travel Credit Cards

To get the most from your card, always use it for travel and dining expenses. These categories often earn the highest rewards. Additionally, pay attention to limited-time promotions and bonus categories.

Another smart strategy is redeeming points wisely. Instead of cashing out for low value, use points for flights or hotel bookings where they stretch further.

Finally, always pay your balance in full. Interest charges can quickly erase rewards. Smart usage ensures that the best cradit cards for travel work in your favor—not against you.

Common Mistakes to Avoid When Using Travel Credit Cards

One major mistake is applying for multiple cards without understanding the terms. This can hurt your credit score and lead to unnecessary fees.

Another common error is ignoring reward expiration dates. Some points expire if unused, so regular monitoring is essential.

Lastly, avoid using travel cards for cash advances. These come with high fees and interest rates. Staying informed helps you enjoy the full benefits of the best cradit cards for travel.

Also Read:Best Flight Booking Site: Fly Smart and Save Money on Every Trip

FAQs

What are the best cradit cards for travel beginners?

Beginner-friendly travel cards usually have low or no annual fees, simple rewards, and flexible redemption options.

Can I use travel points for hotels and flights?

Absolutely. Points can often be redeemed for flights, hotels, car rentals, and travel upgrades.

Do travel credit cards improve credit score?

When used responsibly, they can help build and improve your credit history.